Bookkeeper360 offers tax services that include individual or business preparation and filings, sales and local 1099s reporting, as well as overall tax planning and compliance. The features you receive with Bookkeeper360 will largely depend on what your business needs and what kind of strategy you develop in your consultation. Ultimately you can choose services that range from advisory support to full, hands-on bookkeeping management. The CFO will help in determining and evaluating key performance indicators, performing profitability analysis, developing a growth strategy, and optimizing cash flow. If you’re planning to expand your business but need additional capital, the CFO will help you forecast the business’s financials, craft business plans, and determine the optimal capital structure.

We get things right the first time

That means you’ll spend less time acting as a go-between and have more time to focus on growing your business. https://www.bookstime.com/ The easiest way to answer that question is to start out with your preferred investment approach. Peggy’s Bookkeeping and Tax Service has published its latest article, offering comprehensive bookkeeping solutions, stress-free tax … Bookkeeping is an excellent business you can start from home in your spare time. Find out how you can start a bookkeeping business from home plus some alternative businesses you can start today. We consider the opinions of users and the service’s ratings on various review sites.

Payroll

Bookkeeper360 is a financial technology solution that helps businesses manage their finances. Our US-based accounting team delivers a comprehensive suite of services, including full-service accounting, payroll, tax, and advisory, along with AI-driven software that provides real-time dashboards and insights. Online bookkeeping services can also be more cost-effective than traditional bookkeeping methods. They eliminate the need for businesses to invest in expensive accounting software or hire in-house accountants, since all the necessary tools and expertise are available online.

Best Free Accounting Software of 2024

Bookkeeper360’s greatest downside is its cost; however, those costs are made easily comprehensible (which we always appreciate). A business with $50,000 in monthly expenses would pay $599 per month for monthly support, and $749 per month for weekly support. Their weekly plan will get you a dedicated accounting team, in addition to advanced reporting metrics.

Bookkeeper360 App Support + Help

The two additional Bookkeeper360 plans, “Monthly” and “Weekly” will offer more hands-on support. With the Weekly plan, you’ll receive a dedicated accountant who will perform your bookkeeping on a weekly basis. This plan will also include cash and accrual basis accounting and reporting, as well as invoice and expense management, technology consulting, monthly financial reviews and weekly catchup calls. Online bookkeeping companies will often specialize in services for a particular type of company. Some companies on our list specialize in startups, with strategic cash-burn analysis, Series A-C funding guidance, and tax strategies to boot.

- If you encounter any issues with the Bookkeeper360 App or have some questions, comments, or feedback, you can also reach out directly to your Client Advisor/Bookkeeper360 Team.

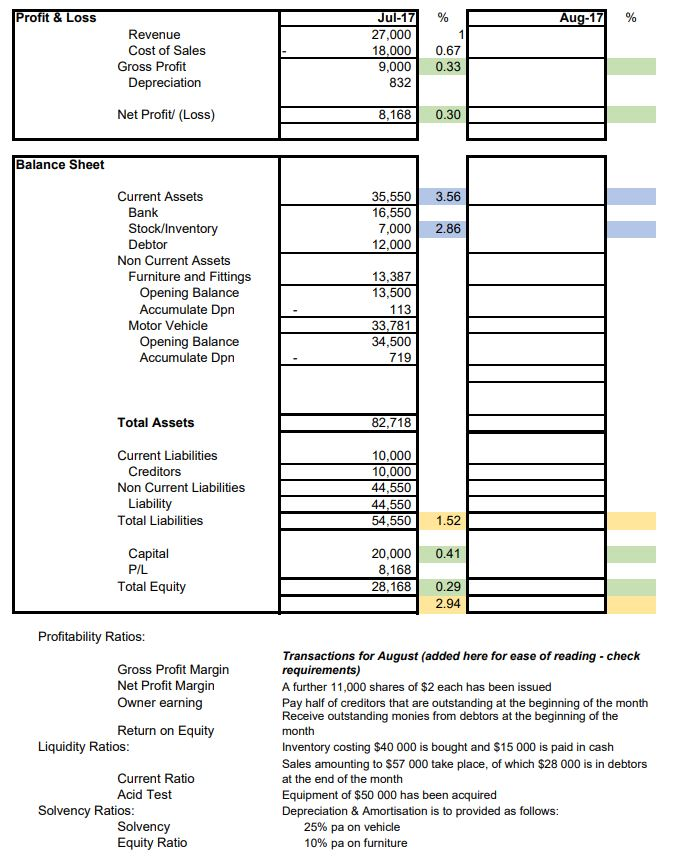

- The charts will show your cash inflows and outflows for the past 12 months, past 24 months, last calendar year, last two calendar years, and last three calendar years.

- With Bench, you not only receive online bookkeeping services but access to its proprietary bookkeeping software as well.

- For example, there is a significant increase in Other Expenses in March 2022 and Advertising Expenses in April 2022.

Plus, with transparent pricing laid out for customers to see, a service provider can’t try and charge you more than it does someone else. Moreover, with each of these service types, you’ll receive U.S.-based support and a platform with which to communicate with the Bookkeeper360 team, making its service not only expansive but accessible. https://x.com/BooksTimeInc When it comes to its payroll services, on the other hand, Bookkeeper360 bases pricing on the number of employees you have. If you have one employee, it will cost $45 per month; if you have 20 employees, it will cost $159 per month. Bookkeeper360 provides a sliding scale tool on its website for this cost.

Using the app, you can keep track of business performance by looking at dashboards and auto-generated reports. You can view profit and loss details, revenues, direct costs, and net income. The three CFO Advisory plans are called “Advisory,” “Coaching” and “Inventory.” The Advisory plan includes services such as KPI reporting, profitability improvements and basic operational processes.

Bookkeeper360 Alternatives & Comparison

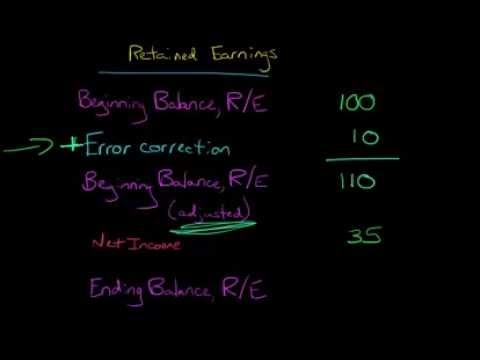

Under cash-basis accounting, revenues and expenses are recorded when cash is paid or received. Meanwhile, accrual accounting records revenue and expenses when earned or incurred. Learn more in our cash- bookkeeper360 vs accrual-basis accounting method comparison, which also covers when to use each. The direct cost column chart above is another chart that you’ll find very useful in costing.

- For cash-basis accounting, pricing starts at $399 per month for companies with up to $20,000 in monthly expenses.

- The firm has made efforts to transform bookkeeping by embracing a revolutionary approach through unique automation solutions that are directed straight at proving their accounting strategies as …

- Unlike Bookkeeper360 and Bookkeeper.com, Bench offers the same service regardless of your plan, the price only changes based on the amount of your monthly expenses.

- These criteria were disregarded for providers where no reviews were found.

- We are so excited to be your trusted partners on your accounting journey.

- Our commitment to excellence and client success has earned us independent recognition as one of the top online bookkeeping solutions by publications such as NerdWallet, Forbes, and Entrepreneur Magazine.

- The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions.

- Another advantage of online bookkeeping services is that they offer real-time data tracking and reporting.

- Bookkeeper360 offers a range of support options for businesses in conjunction with its core bookkeeping services.

- You have the option to create a custom solution; however, you can also choose one of the three pre-designed packages Bookkeeper360 offers.

The Coaching plan is more in-depth, not only providing assistance with overall systems and operations but also strategic planning and executive coaching. Finally, the Inventory plan is designed on a project basis and can accommodate inventory management, workflow planning, inventory projections and reorder points. Bookkeeper360 offers a range of support options for businesses in conjunction with its core bookkeeping services. Bookkeeper360 offers comprehensive bookkeeping services leveraging the power of QBO, alongside setup, training, and ongoing support.